Her er en lille opdatering på aktiemarkedet. Som nævnt i tidligere oplæg, er S&P 500 gået ind i et bull-marked, og det har efterladt Wall Streets topstrateger delt om fremtiden. Goldman Sachs Group Inc. strateger forventer, at gevinsterne vil fortsætte, da andre sektorer indhenter teknologiaktiernes flammende rally. På den anden side peger Morgan Stanleys, Michael Wilson, tilbage til bear markedet i 1940’erne, hvor S&P 500 ralliede 24% før det vendte tilbage til en ny lav.

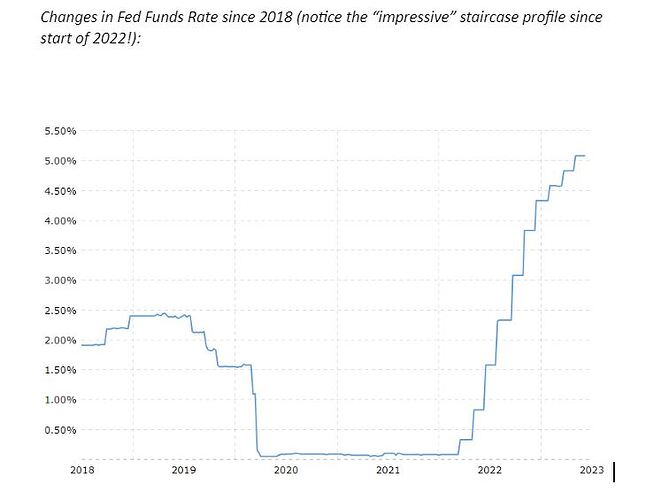

S&P 500 gik ind i et teknisk bull-marked i sidste uge efter at have opnået 20% fra sin oktoberlav, da investorerne satser på robust økonomisk vækst midt i en pause i centralbankernes rentestigninger, en nøglefører for teknologiindustrien. Fokus er nu på Federal Reserves politikmøde denne uge, med den centrale bank endelig forventet at tage en pause efter mere end et år med rentestigninger.

Wilson mener, at denne pause kunne markere slutningen på rallyet “i en ironisk twist”, da likviditeten strammer til. Han forventer, at S&P 500’s indtjening falder 16% i år før en skarp bedring i 2024. Dette står i kontrast til forudsigelser om et fald på kun 2,4% for 2023.

Hos Goldman Sachs ser de dog mere optimistisk på tingene. De mener, at S&P 500 vil fortsætte med at klatre, da sektorer ud over tech indhenter. David Kostin, en af strategerne hos Goldman Sachs, skrev i en note den 9. juni, at “Prior episodes of sharply narrowing breadth have been followed by a catch-up from a broader valuation re-rating”. Siden 1980 har S&P 500 set ni sådanne nøgleepisoder, som blev fulgt af gevinster i andre aktier, der i sidste ende gavnede indekset.

Tidlige tegn viser allerede, med Russell 2000-indekset der overgår S&P 500 siden begyndelsen af juni. Kostin forventer nu, at S&P 500 vil slutte året omkring 4.500 point, hvilket øger hans mål fra 4.000 og antyder gevinster på næsten 5% fra dens fredag lukning.

Historien kan være på Kostins side. Bank of America Corp. strateg Savita Subramanian sagde sidste uge, at en analyse, der går tilbage til 1950’erne, viser, at indekset gik frem 92% af tiden i de 12 måneder efter det bekræftede et bull marked.

Hold jer opdateret om udviklingen, og lad os håbe, at opturen fortsætter!