I have been following the conversation around the BOJ’s rate hike decision and wanted to write a post, it would be great if people give it a read and share any thoughts - please reply in Danish

Why are markets watching the BOJ?

The Bank of Japan (BOJ) will make its latest interest rate policy decision overnight (04:00 CET), giving markets an answer to this week’s speculation. Many market participants suggest tonight’s decision will end the BOJ’s yield curve control (YCC) experiment, which has governed the country’s interest rate policy since 2016, in a dramatic conclusion. The BOJ faces a catch-22, forced to choose between its currency or its bond market. Below I share my take on how it got here and what it means for markets.

A brief history of YCC

Japan first began yield curve control in 2016 to encourage investment and raise inflation to combat falling prices. The BOJ capped the yield of 10-year Japanese Government Bonds (JGBs) at around 0% to encourage borrowing, promising to buy JGBs if the value of the bonds fell such that yields (which move inversely to price) rose above 0%, thereby backstopping its sovereign bond market.

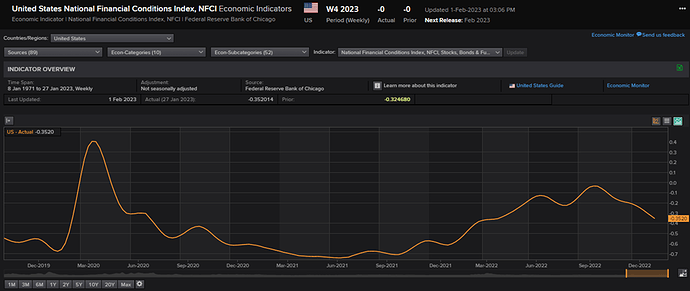

Since 2016 the BOJ was largely successful at capping JGB yields around its target, pinning down borrowing costs but driving investors away from the JGB market due to the low volatility. However, the policy has been slow to drive inflation in Japan and has instead encouraged much investment overseas as a result of the higher interest rates attainable outside of Japan, e.g. in the US. The low bond yields in Japan encouraged Japanese investors to pursue higher returns abroad, with @LukeGromen suggesting yesterday that Japan has accumulated USD 3.2tn of foreign assets, of which USD 1.1tn are of US Treasuries. Another consequence of the YCC was to encourage international investors to borrow in Japanese yen at low/zero interest rates and use the money to earn a yield abroad (e.g. in the US) in what is called a carry trade.

The systematic leverage created through carry trades contributes to why tonight’s meeting is being so closely followed by Wall St. That is because to execute a carry trade, investors must also hedge their currency exchange risk, and that becomes increasingly expensive as Japanese interest rates rise and currency prices become more volatile.

So, when the BOJ raised its YCC target last month on the 10-year JGB from 0-0.25% to 0-0.50%, markets, to fight (finally) rising Japanese inflation and a weakening currency, markets were shocked. The move, first of all, showed markets the BOJ’s commitment to its target has weakened, but maybe more importantly, changed the incentives for Japanese investors and carry traders.

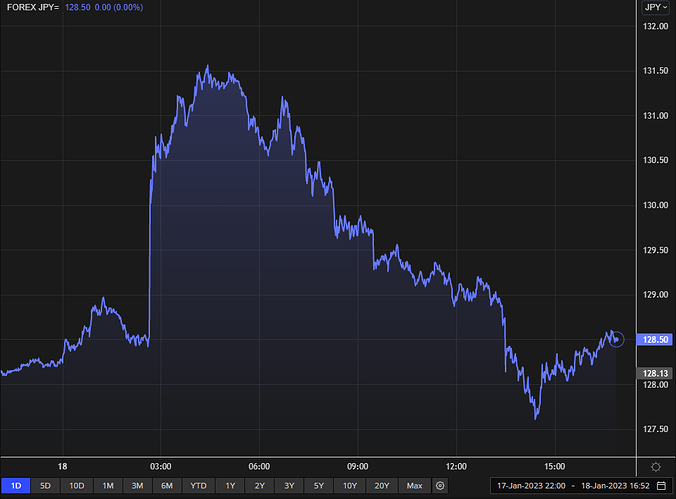

For the first time in a long time, Japanese investors could earn a yield at home, while carry traders were looking at a significantly less profitable trade (due to a lower interest rate differential and increased FX hedging costs). The BOJ’s 20 December 2022 decision has seen the Japanese yen appreciate against the dollar as investors sell dollar-denominated assets to acquire Japanese-denominated ones (Sell USD to buy JPY).

The BOJ at a crossroads

However, as a result of the BOJ’s surprise hike to its interest rate boundary, markets have lost confidence in the central bank’s commitment to its yield curve control, which has inspired hedge funds to make speculative bets that the BOJ will hike this boundary further. And in the month since its policy change, the BOJ has spent over USD 150bn to defend its new interest rate cap, with markets breaking through the boundary on both Friday, 13.01.23 and Monday, 16.01.23.

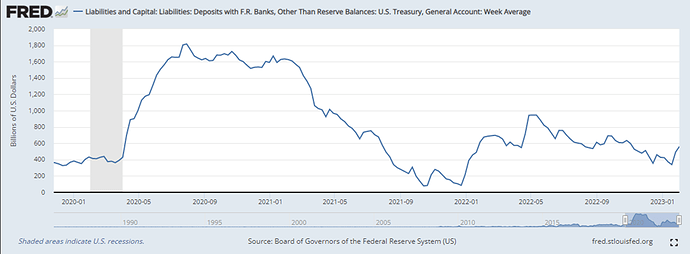

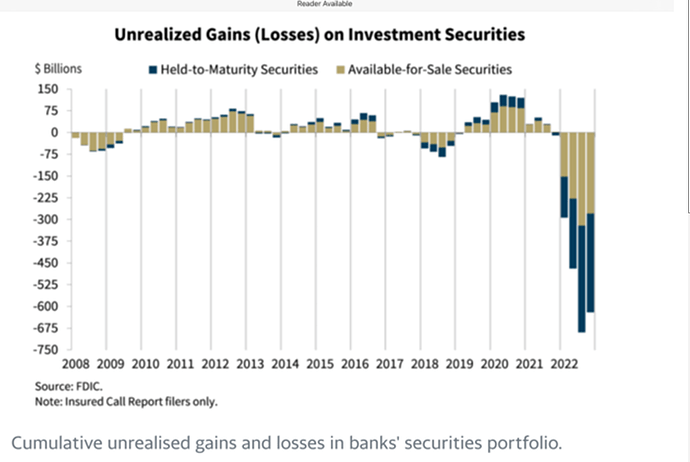

Therefore the BOJ finds itself in a precarious position where it has a choice to either keep defending its yield cap, printing money to keep up with the growing bond purchases necessary to defend its position at the expense of its currency’s value, and risking runaway inflation; or giving into markets and increasing the yield cap further, reducing the value of its JGB values (since rising yields means lower price), and potentially creating a Liz Truss style crisis among Japanese pension funds and insurance companies.

If the BOJ lets its YCC boundary increase further (gives into markets), the yen will likely surge, sending the dollar lower as carry trades globally are unwound. If the BOJ maintains its YCC target, the yen could fall as the BOJ will either have to print increasing amounts of currency or start selling its foreign assets to defend its currency.

I see no good options for the BOJ. I am interested to hear opinions on what people think they will do and what both options mean for Nordic markets.

(again, please reply in Danish)