Swedish Turnaround Case - PRICER

About PRICER

Pricer specializes in providing digital price-label solutions for retailers. Their labels offer retailers a powerful tool to streamline pricing processes, reduce errors, enhance the shopping experience, and implement dynamic pricing strategies. Their Software-as-a-Service model centralizes information, saving employers time and eliminating concerns about server outages and updates. Pricer operates in over 70 countries and has their products equipped in more than 22.000 stores.

Background

From 2015 to 2020, Pricer focused on profitability, with profits being distributed as dividends, resulting in limited growth. In 2020, a significant order from BestBuy, the largest in the company’s history, put Pricer on a growth-oriented path. Nevertheless, the company remained committed to distributing dividends to its shareholders, a decision that ultimately proved to be misguided. It became clear that they should have ceased the dividend in 2020, at least temporarily, to reinvest in the business and capitalize on the newfound growth opportunities.

As COVID came by, they faced a confluence of challenges, including soaring semiconductor prices, escalating plastic prices, rising shipping costs, and difficulties in sourcing essential components and managing shipping logistics.

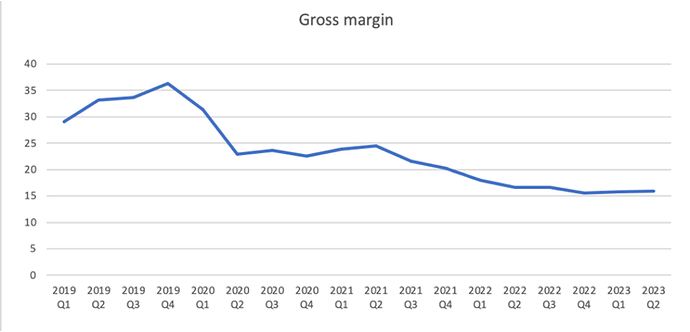

Simultaneously as these consequences unfolded, Pricer had a focus on growth. This contributed to an intense falling gross margin, as they tried to win on price. Their gross margin went from 36,3% in 2019 Q4, to 15,5% in 2022 Q4.

On the 29th of June, Pricer AB’s Board of Directors approved a capital raise of approximately SEK 301 million, including a SEK 44 million Directed Share Issue to Sterling Active Fund and Quaero Capital, and a SEK 257 million Rights Issue for existing shareholders, which was fully guaranteed(thus, increasing the cash position by 257msek). The purpose of the Transaction was to finance the Company’s growth strategy and take advantage of the opportunities presented by the assessed high demand in the market for ESL solutions for in-store automation and communication.

The case today

The gross margin amounted to 16% here at Q2 2023 and continues to be low but showed a positive trend for the second quarter in a row. Management is seeing that component costs are continuing to fall, both in general and due to price negotiation with subcontractors. This, combined with successful customer price negotiations means that they now expect an improvement in gross margin in the second half of 2023. In the long run, their expanded SaaS and software offering, along with an increased share of the four-color labels, will also contribute to an enhanced gross margin.

The market in which they operate in is currently undergoing significant growth. In the second quarter, Pricer had a high order intake and secured a three-year exclusive framework agreement with Carrefour – a huge accomplishment for Pricer.

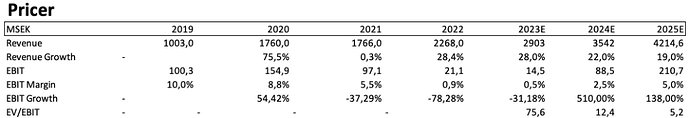

Pricer has a goal of achieving 4.500m sek of revenue in 2025, meaning they would have to grow with a CAGR of 25.5% from 2023-2025.

This is a very optimistic target, which typically would mean these high expectations could be seen in the valuation – not for this case. The company is still trading at an absolutely depressed level as if the low gross margin is the new standard. When huge problems come and have a tremendous influence on a company’s fundamentals, investors tend to overestimate these changes and the time horizon of the challenges.

The drop in gross margin from Q1 2020 to Q4 2020 is due to consequences from COVID-19, and the substantial contract secured with Best Buy, which implied gross margins lower than those in 2019. Conversely, smaller contracts have higher gross margins, than large contracts(like Best Buy). Furthermore, during Q1 2020, Pricer explained the falling gross margin by mentioning factors such as “product mix, large-scale projects, and elevated shipping costs”.

The decline from Q2 2021 to the first half of 2023 is primarily driven by increased component and logistics costs. Under normal circumstances, logistics costs typically account for a relatively minor proportion of total costs, usually in the low single digits, likely closer to 1-2% of COGS rather than 4-5%. However, during peak periods like in 2021-2022, logistics costs can show substantial volatility.

The outlook for 2023 appears promising as the new deals signed indicate an upward trend in average gross margins. The contracts with Carrefour and AFS have shown higher gross margins compared to the current average, a point highlighted during the Q2 conference call.

Bernt Ingman served as the Chairman of the Board from 2017 to 2020, leading the company alongside former CEO Helena Holmgren. During their time, they achieved remarkable growth, and the gross margin reached an all-time high of 36%. Helena stepped down as CEO in 2022.

Now in 2023, Bernt Ingman is back as Chairman of the Board, and ready to clean up. With 257msek added to their cash pile, via the emissions, they are now moving in the right direction. When asked about his priorities at the extraordinary meeting, Bernt Ingmar’s response primarily revolved around margins, cash flow, and the focus on a strengthened balance sheet. Notably, he did not mention growth in his response. Given the current circumstances, it’s reasonable to expect that growth will come naturally since the company stands as one of the leading giants in a growing market.

Risks

Pricer faces multiple risks, including market developments, currency fluctuations, and political factors like import duties. Delays in installations or exchange rate fluctuations can significantly affect quarterly performance. Despite global uncertainty due to the Ukraine conflict, Pricer’s limited exposure has not directly impacted its operations. The long-term effects of this conflict on the company’s business are still uncertain.

Pricer is not recession-resistant, and this lack of resilience to economic downturns poses a significant concern. The company’s performance is closely tied to the standing of the retail industry, and during economic recessions or market contractions, retailers may tighten their budgets and delay or cancel investment projects, including those related to Pricer’s digital shelf labels.

The potential outbreak of a China/Taiwan conflict looms as a geopolitical concern with the potential to disrupt global trade and supply chains. While the direct impact on the ESL(Electronic Shelf Label) industry might be considered a low probability risk, it is prudent to consider the broader implications of such an event

Pricer’s revenue target of reaching 4,500 million SEK in 2025, which implies a substantial CAGR of 25.5% between 2023 and 2025, is notably optimistic and carries a considerable risk of falling short. Furthermore, Pricer aims to achieve 10% recurring revenue by 2025, which adds an additional layer of ambition to their targets. Recently, Pricer talked about their work on persuading existing customers to transition to the SaaS solution(recurring revenue). The results of this project, which CEO Magnus Larsson truly believes in, will become clear within the next year.

However, I would prefer margins over growth and I would not be concerned in the least if the company decided to make a downward adjustment of topline guidance – as long as margins improve. In my point of view, growth will come naturally for Pricer, being one of the giants in a growing market.

Valuation

Historically, Pricer has traded at a P/S of approximately 2x, versus this year’s P/S of 0,4x. They have faced significant challenges, which can be reflected in this low “no-hope” price sentiment. Their current valuation assumes that the low gross margin is the new standard, despite the challengers being temporary. Furthermore, peers such as the market leader SES-imagotag, are forecasting higher margins as well, and are guiding for all-time high margins within a few years.

SES-imagotag is currently trading at an EV/EBIT of 30x based on this year’s consensus. Despite their favorable market positioning and higher margins, it is nevertheless still a high valuation. Describing it as a fair valuation or considering it the “market standard” would not be accurate.

Assuming Pricer does not reach their 2025 revenue target of 4500 million SEK but improves their gross margin as anticipated, my conservative estimates suggest that they could generate approximately 210 million SEK in EBIT in 2025. For a rapidly growing company like Pricer, an EV/EBIT of 15x would be reasonable, equal to a P/S of 0,75x(However, it should not be significantly higher due to the intense competition in this segment).

This scenario would imply a significant upside towards 2025. Considering that the challenges are temporary, there is a strong likelihood that margins can surpass my estimates and revert to levels seen prior to 2020/2021.

Disclaimer: I own shares in Pricer