I have collected my latest thoughts on the product tanker market. I would love to hear thoughts from others about why you think product tanker rates have fallen and what you think of the market for the rest of 2023.

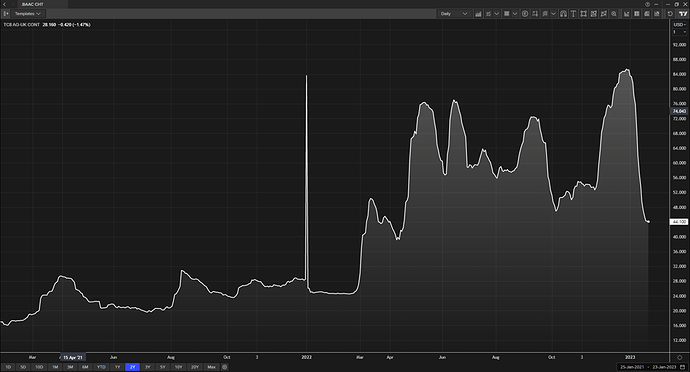

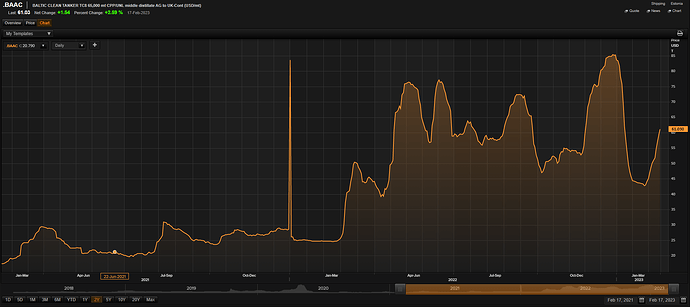

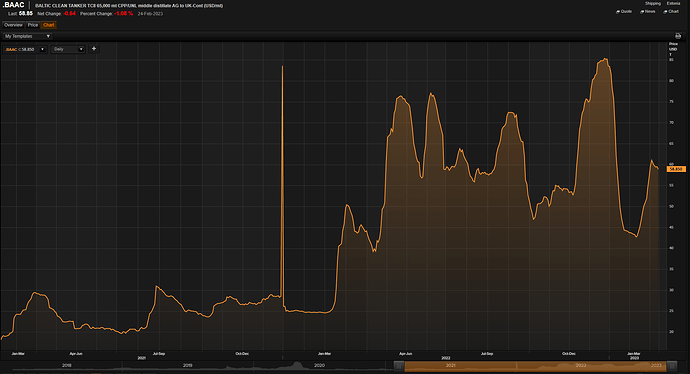

Markets have been speculating lately about how the upcoming ban on Russian clean products will affect product tanker markets and, in turn, the share prices of product tanker owners and operators. In the final months of 2022, product tanker rates surged, resulting in related stocks also performing well. Many market analysts expected rates would remain high into 2023 as the EU’s ban on Russian clean oil products is to come into effect on 5th Feb 2023. However, the Baltic Clean Tanker index shows rates have significantly retreated so far in 2023 (see below).

A possible explanation for the fall in product tanker rates is reduced European gasoline demand from a warmer-than-expected winter, in combination with Europe maximising Russian import volumes ahead of the February 5th deadline, importing 1m b/d so far in January, as reported by shipping news (https://www.hellenicshippingnews.com/product-tankers-and-diesel-supply-for-the-eu-what-to-expect/)

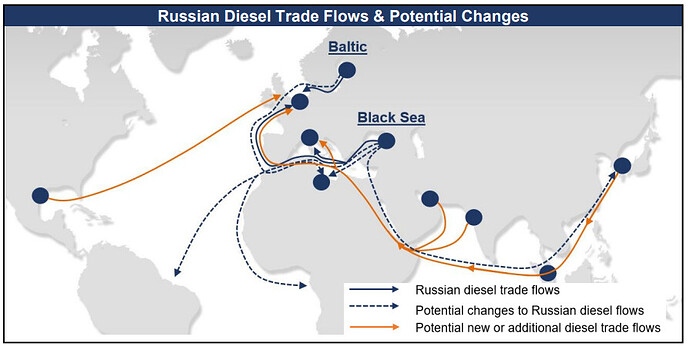

The ban, therefore, raises two questions, what will Russia do with its supply no longer flowing to Europe, and, where will Europe cover the lost supply from?

Investigating the first question, Bloomberg’s Javier Blas recently reported that Russia’s export capacity through 2022 was incredibly robust through 2022, with Blas highlighting that despite repeated EU sanctions, Russia exited 2022 pumping 11.2m b/d in total oil liquids, down just 1.6% (or 190k b/d) from pre-invasion levels. Russia has largely maintained its export levels by redirecting exports to destinations such as India. An interesting point of note is that some new destinations for Russian oil and oil products have seen their exports increase as some of the Russian product is sold back to Europe under the label of a “friendly” nation. Javier Blas suggests India might be doing this in the below tweet and also references the fact that Malaysian exports to China reached 3x Malaysia’s output capacity as evidence for relabelling. [1] [2]

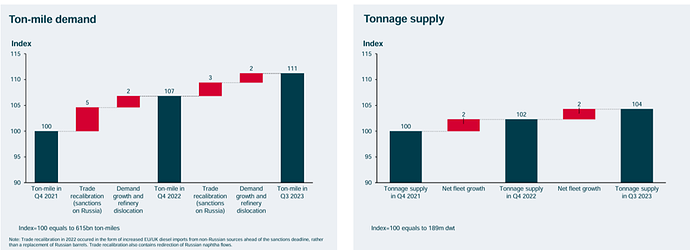

With an EU ban on Russian clean products, Russia will need to find a new destination for its exports to Europe and will lose access to a fleet of European vessels. The evidence presented by Blas suggests that, in the long-run, Russia is likely to resolve these issues and maintain exports at near pre-war levels. However, in the short-run Russian exports of oil products may fall, negatively impacting the product tanker market and the supply of vessels transporting non-Russian oil products could increase, also bringing a negative impact. However, over a longer-term time horizon, the market is likely to re-establish equilibrium with Russian exports moved by non-European vessels.

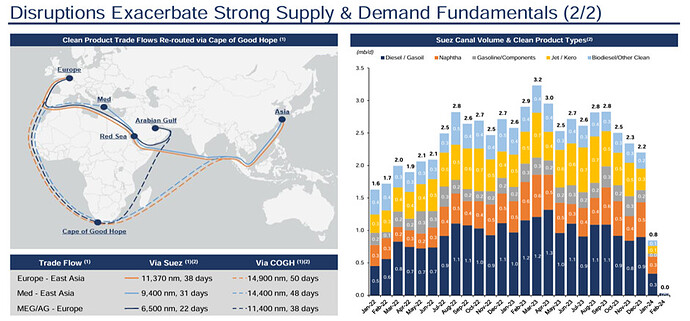

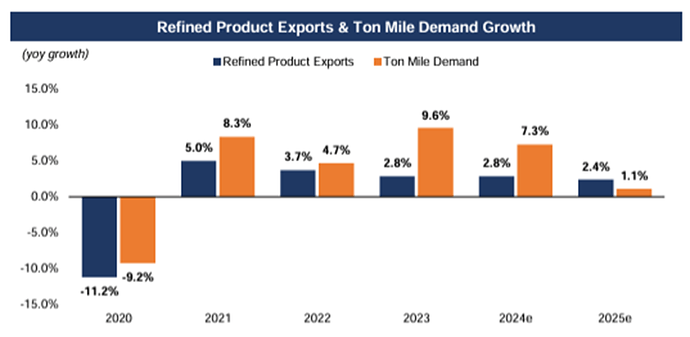

The most significant effect over the longer term is a redirection of flows, leading to an increase in tonne miles as Russia ships its oil products to “friendly” nations such as India further afield. Europe will also need to source its oil products from further afield with the Russian tap firmly closed, also adding to the tonne mile effect. So where will Europe turn? The below report by SPGlobal shows that since Russia’s invasion of Ukraine, Europe has relied heavily on the US to supply increased volumes of oil products.

However, Blas also reported last week that during the second week of January, the US didn’t release any oil from its SPR reserve, suggesting the US should not be looked to make up for the pending deficit. This suggests that Europe will have to go further afield in search of its oil products, increasing the tonne mile effect in the process. The big unknown will be whether Europe is willing to import relabelled Russian clean products, potentially via turkey, as suggested by Bloomberg, or North Africa as suggested by Shippingnews, or whether new flows will come from the gulf or elsewhere in Asia.

In addition to the tonne mile effect, the China reopening should also be positive, and MarineLink recently published an article suggesting that jet fuel trade could increase significantly as a result and end 2023 just 5-10% short of pre-pandemic levels, reflecting a year-on-year growth of 25-30% and as much as a 2% boost to the overall clean petroleum product’ volume. The China reopening will likely provide continued demand-side support, I have previously discussed this view in relation to the household savings rates.

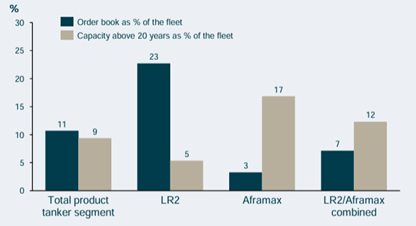

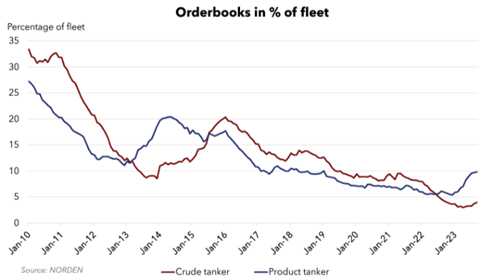

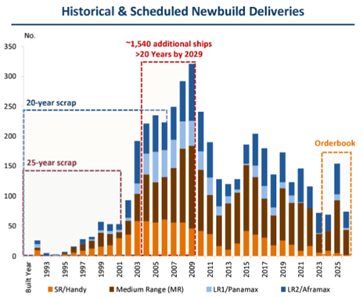

Overall I see there being short-term uncertainties but expect that Russia’s supply will find a new home with time. I think the China reopening story is a large demand-side support, which should outweigh recession fears, and when you consider the tonne mile dynamics and low vessel supply growth, the market conditions should remain favourable. I also saw this view expressed recently by Poten & Partners (link below). However, there are also uncertainties, one of which is a question of how much of these dynamics are already priced into the market, and I think the big unknown is how strict Europe will be regarding relabelled Russian products.

I would love to hear alternative views and for people to share opinions, and even more so if they are contradictory.