THORNCO TO DELIST BRDR HARTMANN WITH A 0% PREMIUM

A cheap egg tray manufacturer has ended up in a huge scandal - how do you profit from it?

This post will be a combination of factual statements, as well as my thoughts on the situation. All quotes included in this article will be directly translated from Danish to English.

After writing about Brdr. Hartmann as my favorite case in the Nordics, the situation changed dramatically when the major owner Thornico, with an ownership stake of 68%, tried to delist the company from the stock exchange. There is nothing wrong with this, and makes perfect sense compared to Thornico’s other companies.

A ridiculous situation has now arisen, as Thornico chooses to bid DKK 300 for the remaining shares, which is below the closing price from the previous day of DKK 301.

People therefore got really confused and the stock ended up at around 297-299DKK the next day.

Due to Danish legislation, however, there have been several misunderstandings, which have resulted in several small shareholders selling their shares.

To quickly go over these reasons, e.g

“You only need to get over 50% of the votes, and then the board will take a decision”

“Astralis on the First North exchange has just been delisted, which only required over 50% of the votes”

Or “Thornico probably already has the approval of other major shareholders, and can thus easily get approval.”

All these statements are basically about the same thing: how many votes does Thornico need to delist Brdr Hartmann from the stock exchange?

To answer that question, we must go back to 2015, when a Danish cruise ship company, Molslinjen, was delisted, when the large shareholder Polaris, with over 50% of the shares made a bid with a 1.5% bid premium. According to Danish listing legislation, this was completely legal, as they had over 50% of the votes (they didn´t have more than 90%). All minority owners must be treated fairly, so due to several complainants, Polaris had to raise the bid by 20% the month after the original bid. This scandal could have been avoided had the shareholders been included at the start, which is why the “deletion rule” was introduced in 2020. It deals with the fact that you must have more than 90% approval of the shares if you want to delist a company - However, this only applies on the Danish main stock exchange and is therefore not valid on First North where Astralis is listed.

What now?

2 days have passed, and Denmark’s largest financial media house, Børsen, is starting to cover the case. The point is: How the hell is it possible to delist a company without a premium?

Christian Stadil (Thornico CEO) explains -

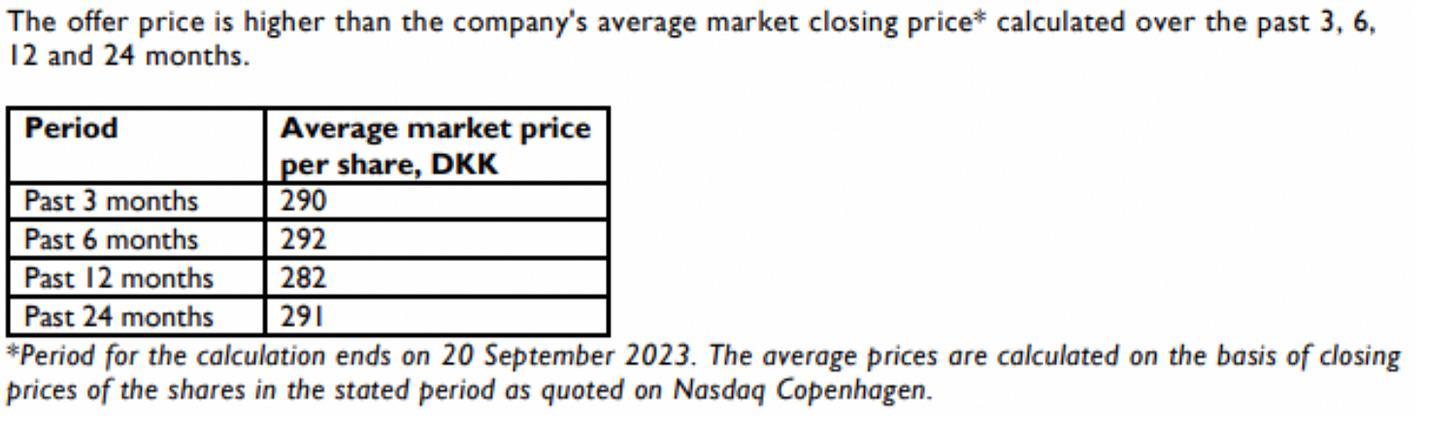

he took the average price over the last 24 months. How in your best imagination can you choose to value a company based on that? Business has possibly gone through the most difficult 24 months ever. All input costs have increased as well as various cases of bird flu.

Apart from this not being stupid enough, you can see in the graph below that they have almost waited for the price to have fallen enough from the top until they start making this bid/valuation. Good timing;)?

The whole valuation part of this case is a big topic of conversation, as it was what started the whole criticism. Is the share worth 300DKK? This question is of course more subjective, but there is broad agreement that 300DKK is too cheap. I have chosen to include 2 different angles to emphasize this point.

Hartmann trades at 6.2 EV/EBIT for this year (Probably even lower if you ask me, but I’ll get into that later), while competitors Huhtamaki and Elopak trade at 13.6 and 9.4 (source, Børsen). They will therefore be able to be traded for 500-600 DKK if they had the same multiple as the Polish Elopak without growth.

The former board member has also been out to comment on the situation, He says the following: " As a private investor, I absolutely hope that a higher offer will come. It’s not an offer I personally want to accept," he says without being able to comment further due to clauses. (Jan Klarskov Henriksen, Børsen)". This man is part of the 3 board members who were kicked out of the management in July.

Suspicious change in management

This leads me straight to the next part of the matter. In July, Thornico began to prepare for the takeover of Hartmann and therefore chose to replace the board so that they could have a majority. Therefore, they now have 3/5 with Thornico affiliation sitting on the board. Therefore, this board can in no way take any kind of factual assessment of Hartmann.

Several have pointed out that if the delisting is rejected, the board can go and find a fair valuation. This is against §3.2 on good management practice, as over 50% of the board has a relationship with Thornico (source, Børsen). Therefore, in the event of a new bid, an objective independent valuation must be made.

In addition to the board, there has been an incredible change in the form of the CFO “stepping” down in July. Through one of my sources, he has, among other things, confirmed that back in April over a call he was incredibly bullish on Hartmann - he then chose to stop 3 months later. Of course, I don’t want to interpret this, but I think everyone can see how sketchy this looks

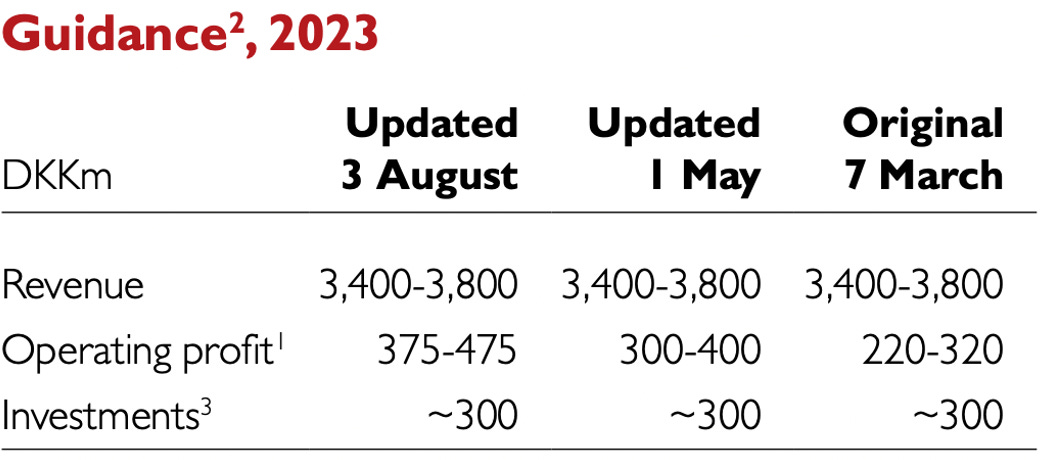

Guidance

Hartmann came up with conservative guidance at the start of the year. They have now adjusted twice, due to lower input prices. They therefore now expect a 55% higher EBIT, which has resulted in the share price increasing by 0%.

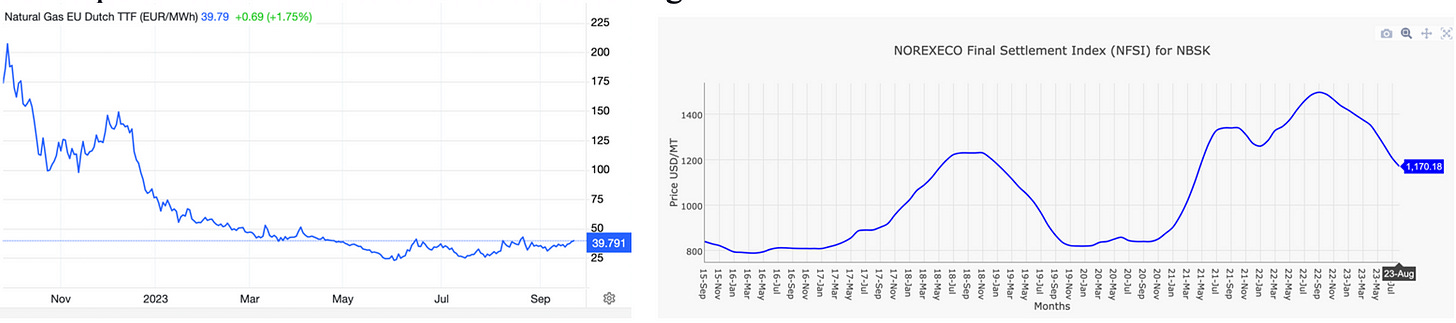

Below are the graphs for gas prices and the price of recyclable pulp. These input factors make up 50% of the total costs and are decreasing.

The management describes that they have set guidance based on an expectation of rising gas prices later in the year.

I am convinced that there will be another upward adjustment, and exactly that could turn out to be a challenge for Thornico. Why has the stock not increased in 2023? I don’t know, and that’s also why I started to take an interest in Hartmann. Either people don’t read the news or some form of price manipulation is being carried out

The general assembly

Only 3 days after Thornico’s request for delisting, they now choose to set a date for the general meeting. In Denmark, you have to give 3-5 weeks’ notice, where of course they only choose to give 3 weeks’ notice, so it will be held on the 16 October. In connection with what I wrote before, I am convinced that they are trying to get Hartmann bought out before November 15, as they don´t want to release their Q3 . Thornico may therefore be under time pressure if their bid does not go through, and they are therefore forced to increase it.

Will the bid go through?

Thornico needs to get 90% of the total voting capital to agree with the bid. Since Thornico together with Hartmann has 70% of the shares, they must get 20% of the remaining 30%, i.e. equivalent to 66% of the remaining shareholders must accept the offer. Handelsbanken and Akita Capital, with respectively 4.85% and 1.78% of the outstanding shares, have already come out and said they are going to say NO to the bid of DKK 300. In addition, Børsen has received confirmation from a third major shareholder that they will also reject the bid. If we assume the third major shareholder has 1% of the outstanding shares, these 3 parties together have 7.6% of the outstanding shares. This means that Thornico must now get 20% of the remaining 22.4%, i.e. 90% of the other shareholders must agree. There are already several groups of minority owners who have also refused to accept the bid. Therefore, this bid will never go through. The question is just now: Why does Hartmann want to make a bid without a premium? Before I found out that the minority owners would vote no, I was convinced that Thornico had gone and talked to major shareholders. This is not the case so why would they bid without a premium when they know the bid will be rejected? - there are only 2 reasons. Either Thornico is incompetent or it’s part of a bigger plan. When I heard that Handelsbanken would vote no, I was convinced that Thornico had deliberately lowballed. Therefore, I now expect that they will come up with an improved bid so that it will look good for the shareholders, as they will now raise the bid by x- percentage.

What I think is happening

This whole thing is changing fast, so everything can be turned upside down in no time. Right now, there are several real options, either the delisting is not adopted and everything continues as usual. At the current price level, this will certainly lead to a drop in the price. As a shareholder, you will be sitting on a cheap company with an irrational big owner. Since more people have now become aware of the low valuation, at the same time as trading at a 50% discount compared to peers, I think this should be priced in. But this scenario is most likely not going to happen unless they try to do price manipulation. Why would Thornico make a bid that they know will be shot down by the shareholders without making a counter bid? The other possibility is that we see a counteroffer, most likely before October 16, or shortly after. According to Danish legislation the board often has an influence on how the company will be valued, but as mentioned earlier, over 50% of the board is associated with Thornico, and this should therefore not be possible. They must therefore have made an independent valuation - this would most likely be in the region of DKK 450-500. The third possibility is that there is a bid for another party, for example, Huhtamaki. However, this won’t be easy with Hartmann’s current management structure. Finally, I see it as a real possibility that the authorities step in. The Danish Financial Supervisory Authority should already have looked at the current situation.

Right now, this case looks attractive, and I expect the share to trade up before the general meeting.

DISCLAIMER: I OWN STOCK IN BRDR HARTMANN